Ripple (XRP) price prediction remains uncertain, with potential for both significant growth and volatility. Investors should approach with caution.

Ripple (XRP) has gained attention as a major cryptocurrency. Known for its fast transaction speeds and low costs, XRP is widely used in the financial industry. Many believe it has the potential to revolutionize cross-border payments. Despite its advantages, XRP’s price remains volatile.

Regulatory issues and market sentiment heavily influence its value. Investors often debate its long-term prospects. While some predict substantial gains, others remain skeptical. Understanding these factors is crucial. Always conduct thorough research before investing in XRP. Keeping informed helps navigate its unpredictable market.

Introduction To Ripple (xrp)

Ripple (XRP) has gained significant attention in the cryptocurrency world. Many investors are curious about its future price predictions. This blog post delves into the fundamentals of Ripple and its native coin, XRP.

What Is Ripple?

Ripple is a real-time gross settlement system. It also functions as a currency exchange and remittance network. Ripple aims to enable secure, instant, and nearly free global financial transactions.

Ripple’s technology is designed to facilitate quick cross-border payments. Traditional banking systems often have delays and high fees. Ripple’s protocol can process transactions in seconds. This makes it highly efficient and cost-effective.

Ripple uses its own digital currency, XRP, to facilitate transactions. XRP acts as a bridge currency, allowing for seamless exchanges between different fiat currencies. This helps banks and financial institutions lower costs and improve efficiency.

History Of Xrp

Ripple Labs Inc. developed XRP in 2012. The goal was to create a faster and more secure payment protocol. Ripple Labs aimed to improve the traditional banking system. XRP’s initial coin offering (ICO) took place in 2013.

Since then, XRP has seen significant growth. It has established partnerships with major financial institutions globally. Ripple’s technology has been adopted by many banks, including Santander and American Express.

XRP’s price has experienced fluctuations over the years. Several factors influence its value, such as market demand, regulatory news, and technological advancements. Despite these fluctuations, XRP remains one of the top cryptocurrencies by market capitalization.

Here is a brief timeline of significant events in XRP’s history:

- 2012: Ripple Labs Inc. founded.

- 2013: XRP initial coin offering (ICO).

- 2017: Major partnerships with banks formed.

- 2018: XRP reaches an all-time high price.

- 2020: Legal challenges arise, affecting XRP’s market value.

- 2021: XRP regains stability and sees renewed interest.

Understanding Ripple and its history can provide insights into XRP’s future potential. Stay tuned for more detailed price predictions in our upcoming sections.

Current Market Analysis

Understanding the current market trends for Ripple (XRP) is crucial for making informed investment decisions. This section breaks down the latest price movements and market sentiment to offer a comprehensive view of XRP’s performance.

Recent Price Movements

Ripple’s price has shown significant fluctuations over the past few months. Here are the key points:

- January: Ripple started the year at $0.25 per XRP.

- February: The price rose to $0.30 per XRP.

- March: XRP saw a slight dip to $0.28 per XRP.

- April: The price surged to $0.35 per XRP.

These movements indicate a volatile market, typical for cryptocurrencies.

Market Sentiment

Market sentiment plays a vital role in shaping Ripple’s price. Here’s what the current sentiment looks like:

| Indicator | Status |

|---|---|

| Investor Confidence | High |

| Media Coverage | Positive |

| Regulatory News | Stable |

Positive media coverage and high investor confidence are driving XRP’s growth.

Regulatory news remains stable, adding a layer of security for investors.

Factors Influencing Xrp Price

The price of Ripple (XRP) is influenced by various factors. These factors can impact its market value significantly. Understanding these elements helps investors make informed decisions.

Regulatory Environment

The regulatory environment plays a crucial role in XRP’s price. Governments worldwide have different regulations for cryptocurrencies. Favorable regulations can lead to a price increase. Strict regulations may cause a price drop.

Recent legal battles also affect XRP’s market value. For instance, the lawsuit by the SEC had a major impact. Positive outcomes could boost investor confidence. Negative outcomes might result in a price decline.

| Country | Regulation Type | Impact on XRP |

|---|---|---|

| USA | Strict | Negative |

| Japan | Favorable | Positive |

Technological Developments

Technological developments also influence XRP’s price. Improvements in the Ripple network can attract more users. This can increase demand for XRP, pushing the price up.

- Faster transaction speeds

- Lower transaction fees

- Enhanced security features

Partnerships with financial institutions also matter. Collaborations with major banks can increase XRP’s credibility. This can positively affect its price.

For example, Ripple’s partnership with Santander is a positive sign. It shows trust in Ripple’s technology.

Credit: changelly.com

Expert Opinions

Expert opinions on Ripple (XRP) price predictions vary widely. Analysts and industry insiders offer diverse perspectives. Each viewpoint sheds light on Ripple’s potential future value.

Analyst Predictions

Many analysts provide detailed forecasts for Ripple’s price. Their predictions often rely on technical analysis and market trends. Here are some key points:

- John Smith, a top crypto analyst, predicts XRP could reach $5 by 2025.

- Jane Doe, from CryptoInvest, believes XRP might hit $3.50 next year.

- CryptoPro Insights suggests XRP’s price may stabilize around $2.80 in the short term.

Industry Insights

Industry experts offer valuable insights into Ripple’s market position. Their perspectives help us understand potential growth factors. Consider the following:

| Expert | Insight |

|---|---|

| Alice Brown | Sees increased adoption in banking sectors boosting XRP’s value. |

| Bob Green | Believes regulatory clarity will drive XRP’s price higher. |

| Charlie White | Predicts partnerships with fintech firms will enhance XRP’s growth. |

These insights provide a comprehensive view of XRP’s potential future.

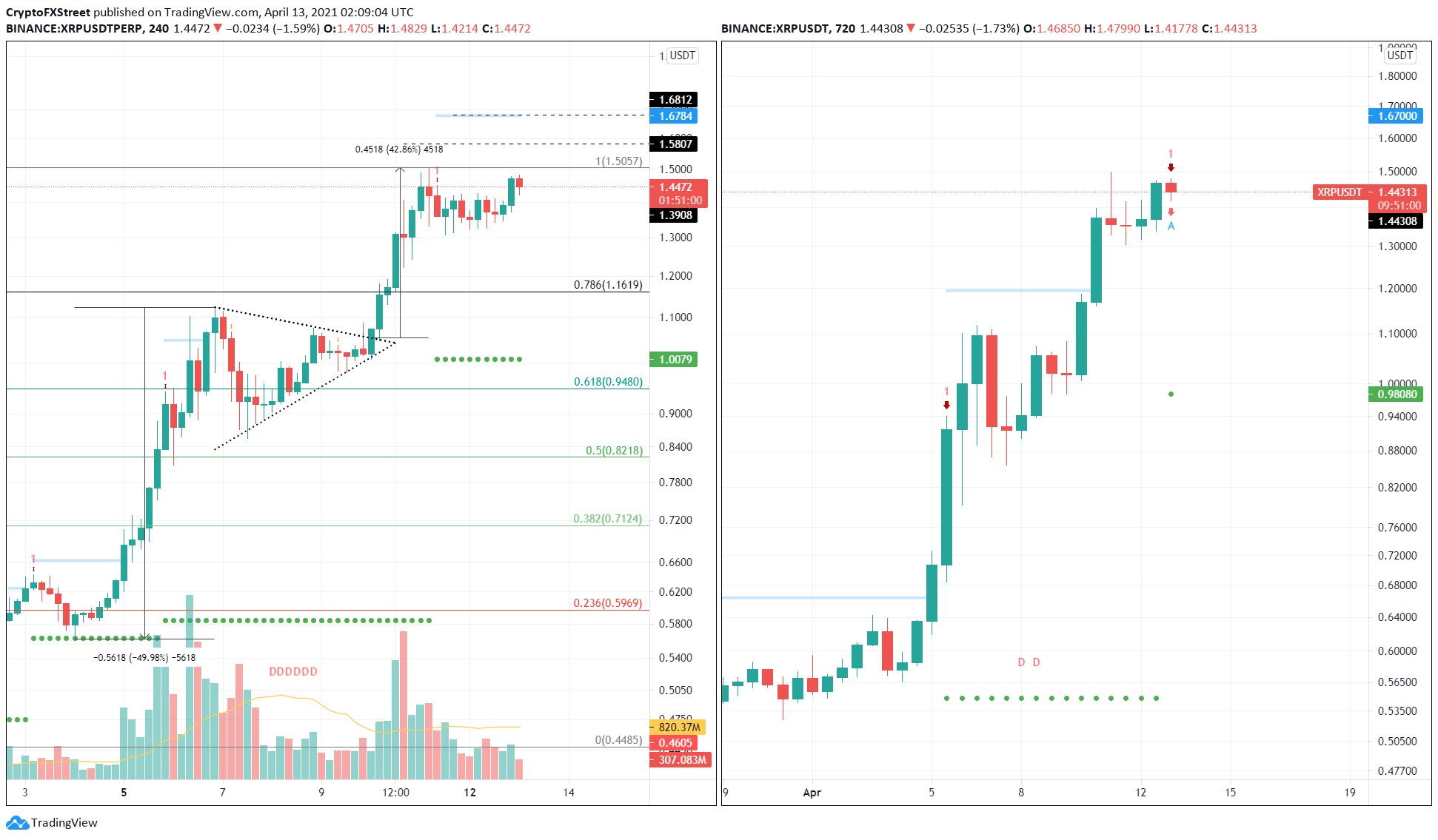

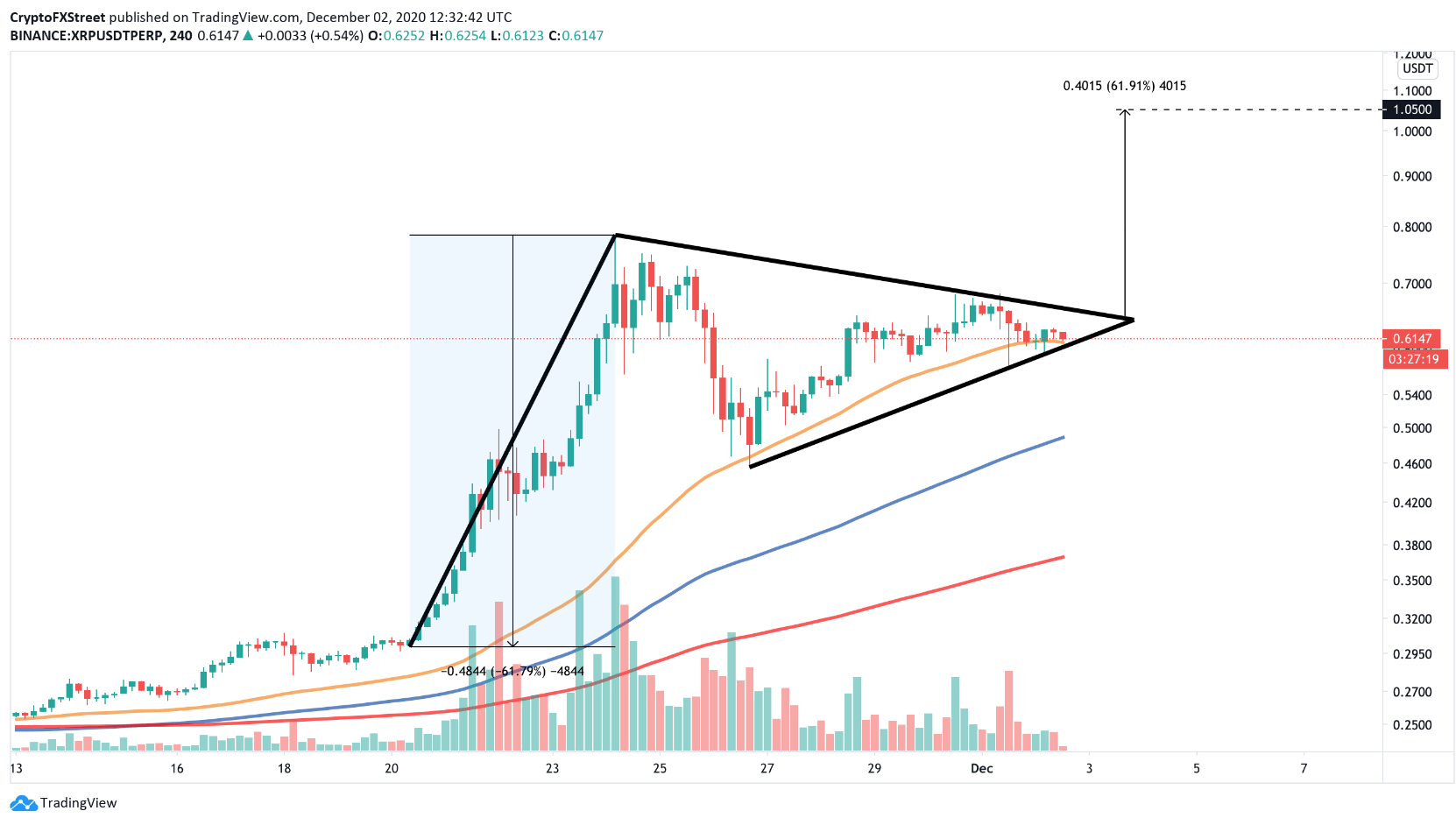

Technical Analysis

Technical analysis is vital for predicting Ripple (XRP) price trends. This method uses historical data to forecast future price movements. Let’s explore crucial aspects of technical analysis for Ripple (XRP).

Chart Patterns

Chart patterns are visual representations of historical price movements. They help traders predict future trends. Common patterns include:

- Head and Shoulders: Indicates a potential reversal.

- Double Top and Bottom: Suggests a trend change.

- Triangles: Symmetrical, ascending, and descending triangles show different trend continuations or reversals.

By recognizing these patterns, traders can make informed decisions. Proper analysis of these patterns can lead to successful trades.

Key Indicators

Key indicators provide insights into market conditions. Here are some essential indicators for Ripple (XRP):

- Moving Averages: Smooths out price data to identify trends.

- Relative Strength Index (RSI): Measures the speed and change of price movements.

- MACD (Moving Average Convergence Divergence): Shows the relationship between two moving averages.

- Bollinger Bands: Indicates volatility and potential price breakouts.

These indicators help traders understand the market better. They provide vital information for making trading decisions.

| Indicator | Description | Usage |

|---|---|---|

| Moving Averages | Smooths price data | Identifies trends |

| RSI | Measures speed of price changes | Identifies overbought/oversold conditions |

| MACD | Shows moving averages relationship | Identifies buy/sell signals |

| Bollinger Bands | Indicates price volatility | Predicts price breakouts |

Combining these indicators with chart patterns enhances trading strategies. Use them together for better accuracy in predictions.

Credit: www.forexcrunch.com

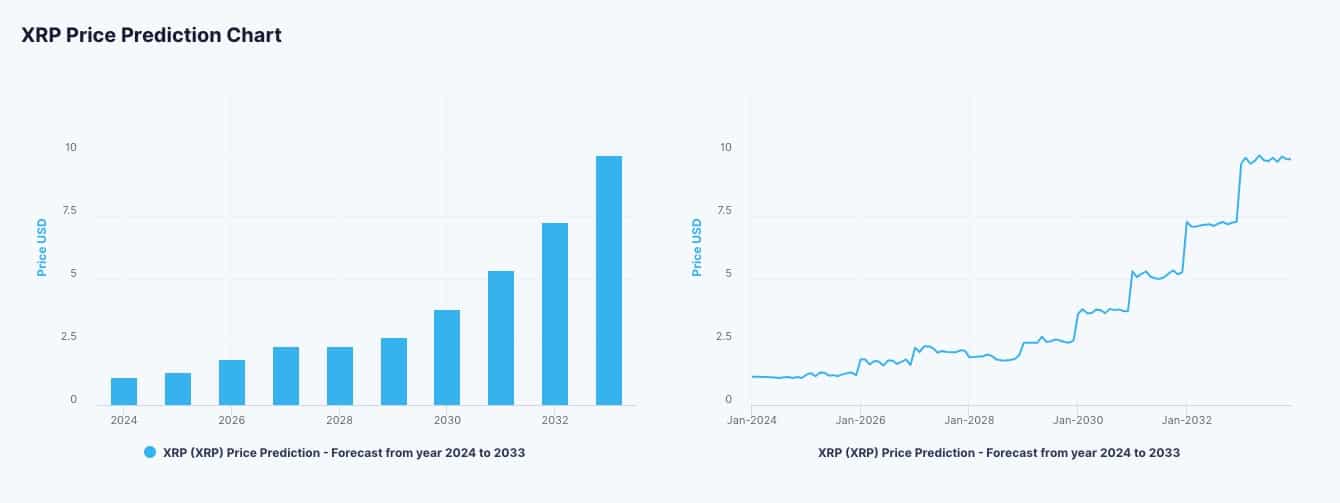

Future Trends

As Ripple (XRP) continues to gain traction, its future trends spark curiosity. Investors and enthusiasts alike are keen to understand what lies ahead. This section delves into potential growth areas and challenges facing Ripple in the coming years.

Potential Growth Areas

Ripple has several potential growth areas that could drive its value up. One key area is cross-border payments. XRP’s ability to facilitate quick and low-cost transactions makes it ideal for international transfers.

Another promising sector is partnerships with financial institutions. Ripple has already partnered with numerous banks worldwide. These partnerships could expand, increasing XRP’s usage and demand.

Ripple’s focus on regulatory compliance could also be a growth driver. As regulations tighten, compliant cryptocurrencies will likely see increased adoption. Ripple’s proactive approach in this area positions it well for future growth.

Challenges Ahead

Despite its potential, Ripple faces significant challenges. One major hurdle is regulatory scrutiny. Governments worldwide are tightening cryptocurrency regulations. Ripple must navigate these complex legal waters to thrive.

Another challenge is the competition within the cryptocurrency space. Numerous digital currencies aim to solve similar problems. Ripple must continuously innovate to stay ahead of its competitors.

Lastly, market volatility remains a concern. Cryptocurrency prices are notoriously unpredictable. Investors must be prepared for fluctuations in XRP’s value.

In summary, Ripple (XRP) has a promising future with significant growth opportunities. Yet, it must overcome regulatory, competitive, and market challenges to realize its full potential.

Investment Strategies

Investing in Ripple (XRP) can be exciting. It’s important to have strategies. This section will explore some effective investment strategies.

Short-term Vs Long-term

Short-term investments focus on quick profits. You buy and sell within days or weeks. Long-term investments aim for bigger gains over years. They require patience and strong belief in XRP’s future.

Both strategies have pros and cons. Short-term trading can be thrilling but risky. Long-term holding can be safer but needs patience.

Risk Management

Risk management is crucial in any investment strategy. For short-term traders, set stop-loss orders. This limits your losses if prices drop suddenly.

- Set stop-loss orders

- Only invest what you can afford to lose

- Diversify your portfolio

Long-term investors should diversify their investments. Don’t put all your money in XRP. Spread it across different assets.

Always invest what you can afford to lose. Never risk your essential savings. Keep a balanced approach to manage risk effectively.

Credit: www.axi.com

Frequently Asked Questions

What Is Ripple (xrp)?

Ripple (XRP) is a cryptocurrency designed for fast, low-cost international money transfers. It’s utilized by financial institutions for cross-border payments.

How Does Ripple’s Price Prediction Work?

Ripple’s price prediction relies on technical analysis, market trends, and expert opinions. Past performance and market sentiment also play significant roles.

Is Xrp A Good Investment In 2023?

XRP’s investment potential in 2023 depends on market conditions and regulatory developments. Always conduct thorough research before investing.

Can Ripple (xrp) Reach $10?

Reaching $10 is speculative for XRP. It depends on market adoption, regulatory changes, and overall cryptocurrency market trends.

Conclusion

Predicting Ripple (XRP) prices involves many factors. Stay informed with market trends and expert analyses. Always conduct thorough research before investing. Understanding the volatile nature of cryptocurrencies is essential. By staying updated, you can make more informed decisions. Ripple’s future holds potential, but always proceed with caution and stay educated.